In today's hyper-connected, rapidly evolving business world, merely having a great product isn't enough. To truly thrive, you need a profound understanding of the Competitive Landscape & Market Impact your business navigates. This isn't just about knowing who your rivals are; it's about dissecting their strategies, anticipating market shifts, and leveraging these insights to sharpen your own competitive edge. Think of it as your strategic GPS, constantly updating to show you the best path forward, identify potential roadblocks, and highlight uncharted territories ripe for exploration.

This guide will demystify the art and science of competitive landscape analysis, transforming it from a daunting task into an indispensable strategic weapon.

At a Glance: Your Strategic Playbook

- What it is: A systematic mapping of your competitive environment, pinpointing direct, indirect, and emerging rivals. It's a snapshot and an ongoing process.

- Why it matters: Uncovers threats, reveals opportunities, fuels strategic differentiation, informs planning, and empowers your sales team.

- How it’s done: Follow a structured approach from internal assessment to visualizing insights, encompassing data collection and analysis.

- Key frameworks: Tools like SWOT, Porter's Five Forces, and the BCG Matrix provide powerful lenses for strategic understanding.

- Data is gold: Utilize competitor websites, social media, specialized tools, and internal data to gather comprehensive market, audience, and product intelligence.

- AI's role: Artificial intelligence can automate and accelerate the analysis of vast datasets, making competitive intelligence more efficient and insightful.

- Continuous evolution: The competitive landscape is dynamic; your analysis must be too, requiring regular updates and ongoing vigilance.

Beyond the Basics: Defining Your Competitive Terrain

A Competitive Landscape Analysis (CLA) is more than just a list of competitors. It's a systematic methodology for charting your entire competitive ecosystem. This includes identifying not only the companies directly vying for your customers but also indirect alternatives and nascent threats. It offers a crucial point-in-time snapshot of market dynamics – invaluable for strategic decision-making – but also functions as a continuous process, demanding regular refreshes as markets, technologies, and competitors themselves evolve.

Unlike continuous competitive intelligence, which focuses on real-time monitoring of specific competitors, CLA provides a broader, more holistic view. It's about stepping back to see the forest, not just the trees. This analysis delves into critical metrics such as:

- Market Share: Who owns what slice of the pie?

- Product Offerings: What are they selling, and what problem does it solve?

- Pricing Strategies: How do they value their offerings, and what does that mean for your margins?

- Website Traffic & Engagement: How are they attracting and retaining attention online?

- Positioning & Messaging: How do they articulate their unique value, and to whom?

- Company Growth & Innovation: Are they expanding, acquiring, or launching new features?

Understanding these elements provides a foundational map, showing you where you stand and where you need to go.

Why Bother? The Undeniable Benefits of a Deep Dive

Investing time and resources into a robust competitive landscape analysis isn't a luxury; it's a strategic imperative. The insights gleaned directly translate into tangible business advantages, impacting everything from product development to sales strategy.

Spotting Danger Before It Strikes: Threat Monitoring

The market is a battlefield, and new contenders emerge constantly. A thorough CLA helps you identify emerging competitors and understand potential market vulnerabilities before they escalate. Are new startups eroding niche segments you thought were secure? Is a large incumbent quietly developing a competing solution? Knowing these threats allows you to proactively adjust your strategy, rather than reactively scrambling.

Unearthing Untapped Potential: Market Opportunities

A clear view of the competitive landscape often reveals hidden gems. By analyzing competitor gaps and customer feedback, you can spot underserved customer needs or market segments where existing solutions fall short. Perhaps customers are expressing frustration with a common flaw in competitor products, or a growing demographic is completely ignored. These insights are pure gold for identifying untapped market potential and sparking innovation.

Carving Your Own Niche: Strategic Differentiation

In a crowded market, simply being "good" isn't enough. A CLA helps you pinpoint what makes your offering truly unique. By understanding how competitors position themselves, what features they emphasize, and what messages they convey, you can articulate your distinct value proposition more effectively. This strategic differentiation isn't just about features; it’s about solving a problem in a way no one else does, or serving a customer segment with unmatched precision.

Charting the Future: Strategic Planning & Decision-Making

Ultimately, a comprehensive CLA empowers leadership with the data needed to make informed strategic decisions. Whether defining a clear market niche, assessing the viability of a new product launch, or preparing for significant market changes, the analysis provides a robust evidence base. It helps answer critical questions like: Should we acquire a smaller competitor? Where should we allocate R&D budget? What market trends should we capitalize on?

Equipping Your Front Lines: Sales Enablement

Competitive insights aren't just for the boardroom. Converting these findings into actionable sales materials—often called battlecards—equips your sales team to confidently articulate your advantages and proactively address competitor claims during deals. Knowing a rival’s weaknesses or a common customer objection can dramatically improve your competitive positioning and close rates. Imagine your sales team confidently answering, "Why us, not them?" with data-backed conviction.

Your 7-Step Blueprint: Building a Robust Competitive Analysis

Creating a truly effective competitive landscape analysis requires a structured, methodical approach. Hunter Sones of Klue offers a highly practical framework that moves from internal introspection to external deep dives and, finally, to actionable visualization.

Step 1: Internal Company Assessment – Know Thyself First

Before you can analyze others, you must deeply understand yourself. This initial step isn't about competitors at all; it's about gaining absolute clarity on your product.

- Capabilities & Use Cases: What does your product actually do?

- Ideal Customer Profile (ICP): Who are you built to serve? What problems do you solve for them?

- Value Proposition: What unique benefits do you deliver?

- Features: What specific functions differentiate you?

- Customer Discovery Channels: How do customers find you?

- Buying Journey: What’s the typical path a customer takes from awareness to purchase?

This internal clarity forms your baseline, allowing you to accurately compare yourself to others later. Without it, you're trying to measure a moving target against an undefined standard.

Step 2: Identify Direct Competitors – Who’s Head-to-Head?

Direct competitors are those you frequently encounter in head-to-head deals. They offer similar products or services, target similar customers, and solve similar problems.

- CRM Data: What names pop up consistently in your sales pipeline?

- Competitive Revenue Analytics: Which companies are you losing deals to?

- Pre-Sales Conversations (e.g., Gong): What competitors do prospects mention on calls? Listen for patterns.

This step is about uncovering your immediate rivals—the ones directly impacting your win rates and market share.

Step 3: Identify Indirect Competitors – The Alternatives

Indirect competitors might not offer the same exact product, but they solve the same fundamental problem for your customers, often through different means. Or, they might be alternative solutions customers consider before even looking at your product category.

- Win-Loss Analysis: When you lose a deal, ask why. Did the customer opt for a cheaper, less comprehensive solution? Did they decide to build their own?

- Churn Analysis: When customers leave, where do they go? Do they switch to a direct competitor, or do they adopt an entirely different approach to their problem?

- Interviews & Surveys: Directly ask former customers or those who didn't convert what alternatives they considered.

Understanding indirect competitors expands your view of the market, revealing the broader set of options your potential customers weigh.

Step 4: Check for Emerging Competitors – The Future Threats

The market is never static. New players, innovative startups, or established companies pivoting into your space can quickly shift the landscape.

- Competitive Intelligence Alerts: Set up alerts for keywords, industry news, and new company registrations.

- Internal Communication Channels (e.g., Slack): Encourage sales, support, and product teams to share competitive intel they encounter.

- Web Searches: Regularly search for keywords related to your product, problems you solve, and new AI tools entering the market.

- Sales Call Recordings: Review conversations for mentions of companies you haven't yet tracked.

This proactive scouting helps you anticipate shifts and identify potential disruptors before they become significant threats.

Step 5: Categorize Competitors by Use Case – Focus Your Fight

Not all competitors compete with you on every feature or use case. Grouping them helps you organize your analysis and tailor your competitive strategy.

- Use Case Overlaps: For example, do certain competitors excel in "market monitoring" while others focus on "battlecard creation" (if these are your product capabilities)?

- Verify with Win-Loss Data: Does your win-loss data confirm that you primarily lose deals to Company A for Capability X, but to Company B for Capability Y?

This categorization allows you to create targeted strategies, rather than trying to compete on every front against every rival.

Step 6: Micro-Analyze Each Product Category – The Deep Dive

Now, it's time for the granular detail. For each categorized area, conduct a deep dive into your competitors.

- Positioning & Messaging: How do they talk about themselves? What pain points do they emphasize?

- New Features & Product Roadmaps: What have they launched recently? What are they hinting at?

- Customer Feedback: Scour review sites (G2, Capterra), social media discussions, industry analyst reports, and, critically, your own win-loss interviews. What are customers saying they love or hate about competitor products?

This step provides the rich, detailed intelligence needed to formulate specific counter-strategies and identify clear areas for your own product development.

Step 7: Visualize Research with SWOT Analysis – Synthesize for Impact

Finally, synthesize your findings into an actionable framework. The SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats) is an excellent choice for this.

- Focus on Opportunities & Threats: While analyzing all four quadrants is important, lean heavily into identifying clear opportunities you can seize and threats you must mitigate, within each competitive category.

- Data-Backed: Every point in your SWOT should be specific and backed by the data you’ve gathered. Don't just say "strong marketing"; identify how their marketing is strong (e.g., "high organic search ranking for X keywords," "successful influencer campaigns").

Visualizing your research makes it easier for stakeholders to grasp complex information quickly. Clear, concise summaries backed by data are key.

Powerful Lenses: Essential Frameworks for Seeing Your World Clearly

Beyond the step-by-step process, several established frameworks offer powerful lenses through which to analyze and interpret your competitive landscape. Each provides a unique perspective, helping you uncover different types of insights.

SWOT Analysis: Your Strategic Compass

As mentioned in the 7-step process, SWOT is fundamental. It assesses internal Strengths and Weaknesses of your company, and external Opportunities and Threats in the market. Its power lies in its simplicity and ability to synthesize complex information.

- How to use it: After gathering data on yourself and competitors, populate each quadrant. Be brutally honest about weaknesses and specific about opportunities.

- Insight it provides: A high-level strategic overview, highlighting areas for leveraging strengths, mitigating weaknesses, seizing opportunities, and defending against threats.

BCG Growth-Share Matrix: Portfolio Management at a Glance

Developed by the Boston Consulting Group, this matrix helps companies analyze their product portfolio based on market growth rate and relative market share. Products are categorized into:

- Stars: High growth, high share – often require heavy investment but can generate significant returns.

- Question Marks: High growth, low share – potential stars but uncertain future; careful investment decisions needed.

- Cash Cows: Low growth, high share – generate more cash than they consume; fund other ventures.

- Dogs: Low growth, low share – often generate low profit or even a loss; consider divestment.

- How to use it: Plot your own products (and sometimes key competitor products) on this matrix.

- Insight it provides: Guides investment decisions and resource allocation across your product portfolio, helping you decide where to double down and where to pull back.

Porter’s Five Forces: Understanding Market Attractiveness

Michael Porter's framework analyzes the overall attractiveness and competitiveness of an industry by examining five forces:

- Competitive Rivalry: How intense is the competition among existing players?

- Threat of New Entrants: How easy or difficult is it for new companies to enter the market?

- Bargaining Power of Suppliers: How much leverage do your suppliers have over you?

- Bargaining Power of Buyers: How much leverage do your customers have over you?

- Threat of Substitutes: How easily can customers switch to alternative products or services from outside your industry?

- How to use it: Assess each force for your specific industry or market segment.

- Insight it provides: Helps identify the fundamental challenges and opportunities within a market, especially crucial for market entry decisions or assessing long-term profitability.

Strategic Group Analysis: Pinpointing Your Closest Rivals

This framework groups competitors with similar strategies. Instead of viewing all competitors as one amorphous mass, you identify clusters of companies that compete in similar ways, perhaps on price, product diversity, geographic coverage, or marketing channels.

- How to use it: Map competitors based on key strategic dimensions relevant to your industry (e.g., "premium pricing vs. budget pricing" on one axis, "broad product line vs. niche focus" on another).

- Insight it provides: Helps pinpoint your closest rivals (those in your strategic group) and understand the precise nature of the competitive pressure you face. It also highlights groups you might want to join or avoid.

Perceptual Mapping: How Customers See You

A visual technique that plots products or brands on a graph based on how target customers perceive them across key attributes. For example, you might map based on "price (high-low)" and "quality (basic-premium)."

- How to use it: Gather customer perception data through surveys or focus groups, then plot your brand and key competitors.

- Insight it provides: Reveals how customers truly view your product relative to competitors, helping identify perceptual gaps, opportunities for repositioning, or areas where your messaging might be off. If customers think you're "basic" when you aim for "premium," you have a problem.

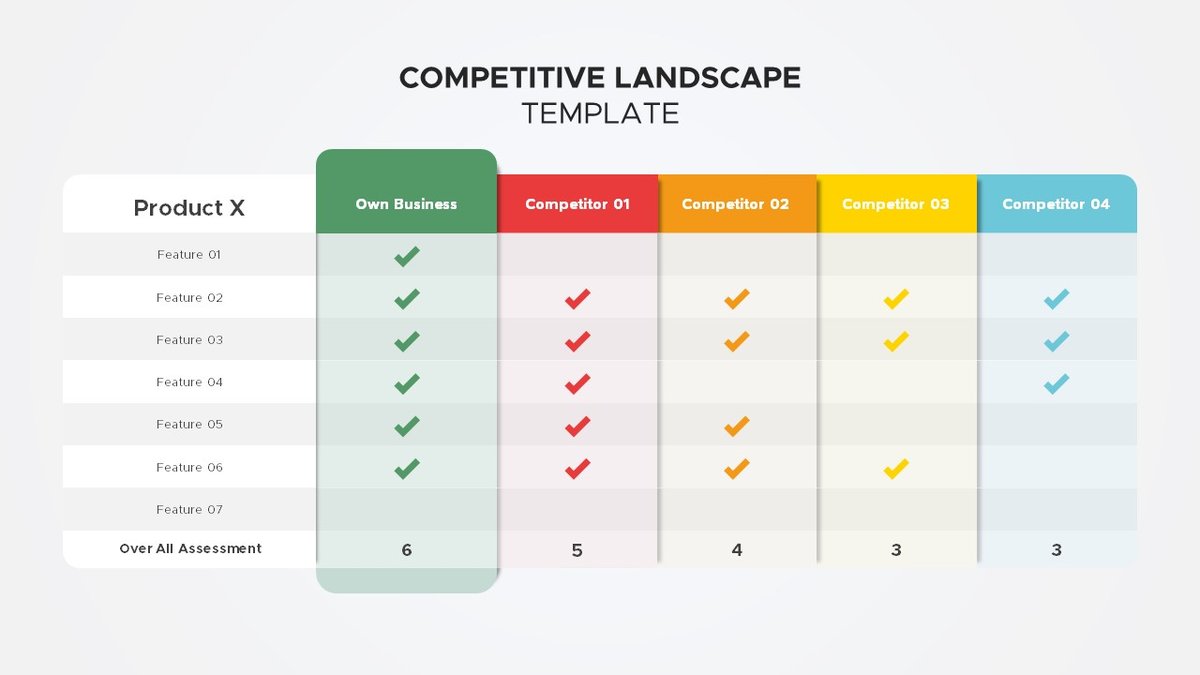

Feature Comparison Tables: The Battlecard Essential

These are detailed charts that compare specific features, capabilities, and often pricing across different competitors.

- How to use it: Create a matrix with competitors as columns and features/pricing points as rows. Populate with data, noting strengths and weaknesses.

- Insight it provides: Highly tactical, these tables are invaluable for sales teams as battlecards, allowing them to quickly highlight your advantages against specific competitor offerings during a sales call. They also inform product development about feature gaps or opportunities.

The Data Dive: Where to Unearth Golden Insights

Theoretical frameworks are powerful, but they're only as good as the data feeding them. The good news is, in the digital age, a wealth of competitive data is readily available. You can gather insights from competitors' websites, social media channels, public financial reports, and increasingly, specialized industry tools like Semrush Traffic & Market, which can offer deep dives into digital performance.

Overall Market Landscape Data: The Big Picture

To understand your competitive standing, you need a holistic view of the market.

- Market Overview Dashboards: Tools can visualize competitor standing (e.g., in a Growth Quadrant), market share, growth rates, Total Addressable Market (TAM), and Serviceable Addressable Market (SAM).

- Traffic Channel Dominance: Analyze how competitors acquire traffic—Direct, Search, Referral, Social. Are they masters of SEO, or do they rely heavily on paid ads?

- Historical Data: Look beyond the present. Historical data offers invaluable insights into how the market has evolved, who's gained or lost ground, and emerging trends.

This macro-level data helps you understand the playing field and identify major shifts.

Audience Landscape Data: Who Are They Targeting?

Understanding your competitors' audience is crucial for refining your own targeting and messaging.

- Demographics Dashboards: Provide insights into the market audience's age and gender breakdown. Are competitors targeting a younger demographic than you?

- Audience Overlap Tools: Show shared customer bases among competitors. If you share a high percentage of customers with a specific rival, they are likely a very direct competitor.

These insights help you refine your ideal customer profile and identify underserved segments.

Product Landscape Data: What Are They Building & Promoting?

Beyond declared features, understanding product landscape data reveals what competitors are truly focusing on and how they're bringing it to market.

- Top Pages Dashboards: Reveal competitors' most popular web pages. Are they feature pages? Blog posts? Landing pages for new products? This often indicates their growth strategies or current product focus.

- Marketing Trend Tracking Tools (e.g., EyeOn): Track competitor marketing activity, including Google Search Ads, new blog posts, website page changes, and social media campaigns.

- Product Rollout Timelines: By tracking these trends, you can often deduce timelines of product rollouts, promotions, and feature launches, giving you a heads-up on their innovation cycle.

This granular data on product and marketing activity helps you anticipate moves and respond strategically. Perhaps you'll find inspiration for a new feature from a competitor's less-than-stellar Kindle Generations launch.

Beyond the Spreadsheet: Making Your Insights Actionable

Gathering data and applying frameworks is just half the battle. The true value of a competitive landscape analysis lies in its ability to generate actionable insights for stakeholders across your organization. Effective visualization and reporting are paramount.

Principles of Powerful Visualization:

- Clear Headlines: Every chart, graph, or table needs a concise, informative headline that summarizes its key takeaway.

- Brief Annotations: Don't make stakeholders guess. Add short, direct annotations to highlight critical data points or trends.

- Updated Dates: Always include the date the data was last updated. Market dynamics change quickly.

- Consistent, Simple Visual Styles: Stick to 3-4 colors maximum, use consistent symbols, and label directly on graphs rather than relying solely on legends. Avoid visual clutter.

- Focus on the "So What?": For every piece of data, be ready to explain its significance. What does this mean for our strategy?

Tools for Visualization:

- Spreadsheets (Excel, Google Sheets): Simple but effective for basic tables and charts.

- Whiteboards & Sticky Notes: Great for collaborative brainstorming and strategic group analysis.

- Presentation Software (PowerPoint, Google Slides): For compiling final reports.

- Advanced Platforms (Google Looker Studio, Tableau, Power BI): For dynamic, interactive dashboards that can be updated in real-time.

Remember, the goal isn't just to present data; it's to tell a story that drives strategic business decisions. Make it easy for your audience to understand, remember, and act upon.

The AI Edge: Supercharging Your Competitive Intelligence

The sheer volume of competitive data available today can be overwhelming. This is where artificial intelligence shines, transforming the competitive landscape analysis process.

AI-powered competitive intelligence software, like Klue Insights, can significantly enhance CLA by automating the analysis of unstructured data sources. Imagine being able to:

- Rapidly Process Competitor Reviews: Instead of manually reading thousands of reviews, AI can identify recurring themes, sentiment shifts, and common pain points users experience with competitor products.

- Extract Insights from Win-Loss Interviews: AI can transcribe and analyze hours of interview recordings, pinpointing key reasons for wins and losses, competitor mentions, and emergent customer needs.

- Analyze Sales Call Recordings: Discover new competitors, unearth common objections, and identify competitor positioning statements directly from your sales team's interactions.

This automation allows for the rapid identification of patterns, themes, and sentiment that would take humans weeks or months to uncover. AI complements traditional research by accelerating data processing, freeing up analysts to focus on higher-level strategic interpretation rather than manual data entry. It makes the CLA creation process faster, more accurate, and ultimately, more powerful.

Your Competitive Advantage: A Continuous Journey

Understanding the competitive landscape and its market impact isn't a one-and-done project. It's a continuous, dynamic, and absolutely crucial component of a modern business strategy. The market doesn't stand still, and neither should your analysis.

By embracing a systematic approach to competitive landscape analysis—from initial internal assessment to ongoing data gathering and AI-powered insights—you empower your organization to:

- Proactively identify threats before they become crises.

- Uncover valuable market opportunities that others miss.

- Sharpen your strategic differentiation to stand out in a crowded market.

- Make confident, data-backed decisions about your future direction.

- Equip every team member with the knowledge to succeed.

In essence, a comprehensive and ongoing competitive landscape analysis is your most powerful tool for navigating complexity, seizing opportunities, and ensuring your business doesn't just survive, but truly thrives, defining its own path to success.